Introduction to futures

Futures are financial instruments that I deal with daily in my professional life, yet to most of my friends, they feel obscure and especially the word "derivative" makes them get goosebumps. I hope that after reading this article, futures will become familiar and straightforward to you.

Futures are financial instruments that I deal with daily in my professional life, yet to most of my friends, they feel obscure and especially the word "derivative" makes them get goosebumps. I hope that after reading this article, futures will become familiar and straightforward to you.

Futures are forwards that are traded on the exchange

To be honest, I could just write above sentence and conclude the article. If you could remember one thing from what I've written, it should be the title of this section:

Futures are forwards that are traded on the exchange.

A forward contract is an agreement between two parties, where one side buys good G from the other for price P, at a future date T. The detail, that goods are delivered and paid for in the future, is what differentiates a forward from a regular purchase. The moment of exchanging goods is called the settlement of the contract.

Usually, if you want to buy something, you just go to the shop and pay money in exchange for the goods instantly – on the spot. If instead, you would enter an agreement with the vendor, which obliged both of you to perform that transaction at some future date at the predetermined price – that would be a forward transaction. What makes forwards interesting is that the price is already determined at the moment of entering the contract.

Because the contract is entered into directly by two counterparties, it is called an over-the-counter product (OTC for short), in contract to exchange-traded products. Furthermore, that requires trust – what if the other party changes their mind between the contract signing date and a settlement date? In the finance world, that kind of risk is called the credit risk – when we're not sure that the counterparty will hold their end of the bargain up.

Given this requirement, usually, only large financial institutions and trustworthy entities enter forward transactions with each other. Forwards are generally not available for small investors directly. This risk is especially prominent, as the other party will most likely default (not pay their obligations) on the forward when the transaction turns out to be settled at a loss to them.

Pricing forward contracts

Let's make one concrete example of a forward trade. We want to enter a contract with a large bank on 1st of January 2017 to buy 1 ounce of gold on 1st of January 2018.

Additionally, a price of gold today (1st of January 2017) is 1200.00 USD per ounce and the safest one-year bond yields 2%.

With that information, what would be the fair price you would buy gold for on 1st of January 2018? A fair price is one for which you could both buy and sell a good, and you wouldn't be at a disadvantage doing either of these things.

Having 1200.00 USD today, you could buy an ounce of gold and hold it for a year. Alternatively, you could invest it in a bond, turning it into 1224.0 USD at the end of the period. Since both of these alternatives cost the same in terms of today's dollars, they're equivalent at the time of signing a contract. The fair price of an ounce of gold of gold on 1st of January 2018 is 1224.0 USD.

We can write down a formula for pricing forward contracts:

\[ F_T = S_t e^{r(T - t)} \]where

\[ \begin{align*} T &- \textrm{settlement date} \\ t &- \textrm{contract signing date} \\ T-t &- \textrm{time to maturity} \\ F_T &- \textrm{Forward price} \\ S_t &- \textrm{Spot price} \\ r &- \textrm{interest rate} \end{align*} \]An important thing to be aware of is that this price is only fair when the contract is entered. During the following year, the price of gold to be bought on the spot-\(S_t\) will fluctuate

and may end up significantly higher or lower than the \(F_T\) we've determined. Even though when the contract was signed, the price was fair, when it will be settled, one party most likely will have a significant advantage.

In other words, it may happen that after a year (on 1st of January 2018) one ounce of gold will cost 1400.0 dollars due to the high demand and uncertainty in the stock market. At the same time, we'll be paying only 1224.0 dollars for it (as agreed beforehand), which means the transaction would be profitable for us. That's also why the trust that our counterparty will hold their end of the deal up is so important when entering the contract.

Futures are traded on the exchange

As I've mentioned in the previous sections, forwards are entered into directly by two counterparties and bear credit risk.

Futures contracts are very similar in most ways – the participant is obliged to buy a particular good at a predetermined price on a future date. The difference is that futures are standardized and exchange-traded.

To make one liquid global marketplace for goods in future delivery, unit size, settlement dates and contract terms are fixed and the same for every participant – available for all investors via public exchanges. Exchanges are stable, regulated, transparent and liquid venues that intermediate trade between counterparties. In general terms, futures are available for the largest and most liquid markets in the world, although one can find a few ones that are relatively obscure and barely traded.

When executing a trade on the exchange, you don't know who you're entering the contract with. You send an order, and once it's executed, you have a position open. The other party does the same, and the buys and the sells are matched anonymously by the algorithms on the exchange. Since futures are just contracts, there is no difference between "buying" and "selling" -- these are just two sides of the same contract.

One may ask if we don't know who we are transacting with, how do settle the trade? Who do we pay or who will pay us? This is the moment, where the clearing house comes into play. They are entities closely connected to the exchanges, which provide clearing services for all trades performed.

According to the wikipedia[3], "clearing denotes all activities from the time commitment is made for a transaction until it is settled.". That's a pretty generic statement, giving very little insight into what does it involve.

So let's take a look into a more specific resource – CME Group (world's largest option and futures exchange) informational website glossary entry on clearing:

The procedure through which a clearing house becomes the buyer to each seller of a futures contract and the seller to each buyer, and assumes the responsibility of ensuring that each buyer and seller performs on each contract.

That illustrates a bit more about the process. When we execute the trade, we are matched with another trader. But from our perspective, our counterparty becomes the clearing house. The other side also transacts with the clearing hourse and only they now that these two orders were matched to each other.

We need to make one digression here and mention another concept linked closely to trading futures – margin. Before we can execute any trade in the futures market one needs to post collateral to the exchange (or through a broker) that will be used for covering any obligations.Before any trade is executed, a credit check is performed to assert that a posted margin is larger than an initial margin requirement for that position. Usually, exchanges allow to some extent for netting out the margin requirements so e.g. for spread positions margin requirements are smaller than for individual legs.

At the end of each trading session, a settlement price for each futures contract is determined, usually as a weighed average of price over a period shortly before the market is closed. The futures trades are settled daily, which means that after a settlement price has been determined, your account will be credited or debited the difference between the price you've entered the contract and the settlement price.

Where does this money come from? A margin of one of the counterparties taking part in the trade. Clearing houses monitor every margin account level carefully versus the maintenance margin requirement -- the minimum required to maintain the position, which should always be enough to cover any loss that may result from holding this position over the next day. If that requirement is not met a margin call is issued which is a call from the broker to the investor to post additional margin. If this request is not met, then certain positions will be liquidated for that account holder at the current market prices.

With above procedures, exchanges and clearing houses manage to almost completely remove the credit risk from futures markets. At the end of each trading session, one account is credited, and another is debited a certain amount depending on the current market prices – a clearing house is an entity managing the process. In the end trading futures is the zero sum game, what one side is earning another side is losing. To make sure that everyone has enough funds to settle their trades, each investor needs to keep margin posted at the exchange.

What about good delivery then? Firstly, a vast majority of futures are not delivered, most often traders close out their position before expiry. Still, a small fraction of the futures will get delivered. Some, like equity index futures or certain interest-rate products are cash-settled, which means delivery happens in the priced mark-to-market cash equivalent of the underying. But some futures indeed have physical delivery, which means that holding the contract until expiry will actually result in delivery of the underlying. There are numerous checks happening at the exchange and brokerage that should protect against such event happening, but there is at least one record online of a failed futures delivery [7].

Futures are derivatives

Futures are financial derivative contracts – they derive their value from an underlying asset. Like we've seen before it's just a contract between two counterparties on the future delivery of a good.

Derivatives fulfill an important role in the financial world, allowing investors to hedge their risks. Whether you're an airline, exposed to fluctuations in fuel prices, a corn farmer facing uncertainty at which price you'll be selling your goods or a US manufacturer buying parts from Europe in Euros – most human endeavors are exposed to multiple different sources of risk. Futures markets allow such entities to lock in the future price of goods to a known value beforehand, bringing predictability in future cash flows.

On the other side of the market, we have the speculators – hedge funds and day traders who take that risk and manage it, hoping to turn in a profit.

What kind of futures are there?

We've already talked quite a lot about futures, but without any concrete data.

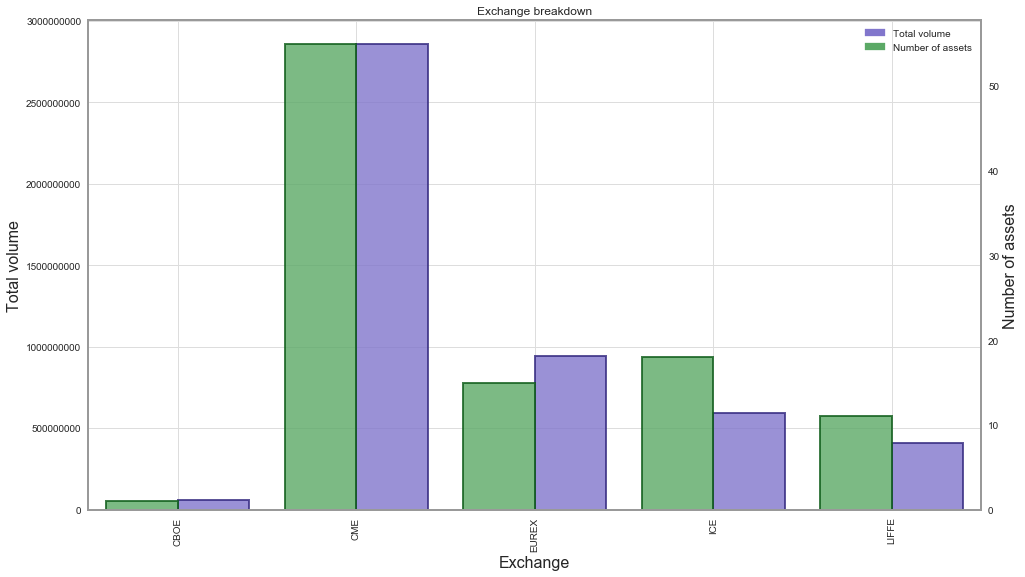

To bring bring in some real-world examples, I've downloaded a quite extensive data set from Quandl[5] including five major US and European exchanges – CME group, Intercontinental Exchange(ICE), Eurex Exchange, Chicago Board Options Exchange (subsidiary of CME group) and London International Financial Futures Exchange(LIFFE, subsidiary of ICE). Together, they cover most of the European and North American volume, but it's vital to remember we're not accounting for the activity happening in Asia, South America, Russia, Australia and other places.

Below you can find a breakdown of volume and number of assets among these exchanges:

From this data set, I've summed total traded volume of all contracts traded for each asset for the year 2016. We can see a fat-tailed distribution of volume, where 100 most heavily traded underlyings account for 99.3% of activity. Top 10 account for 56.1%, top 20 account for 73.4%, and top 50 for 93.3%.

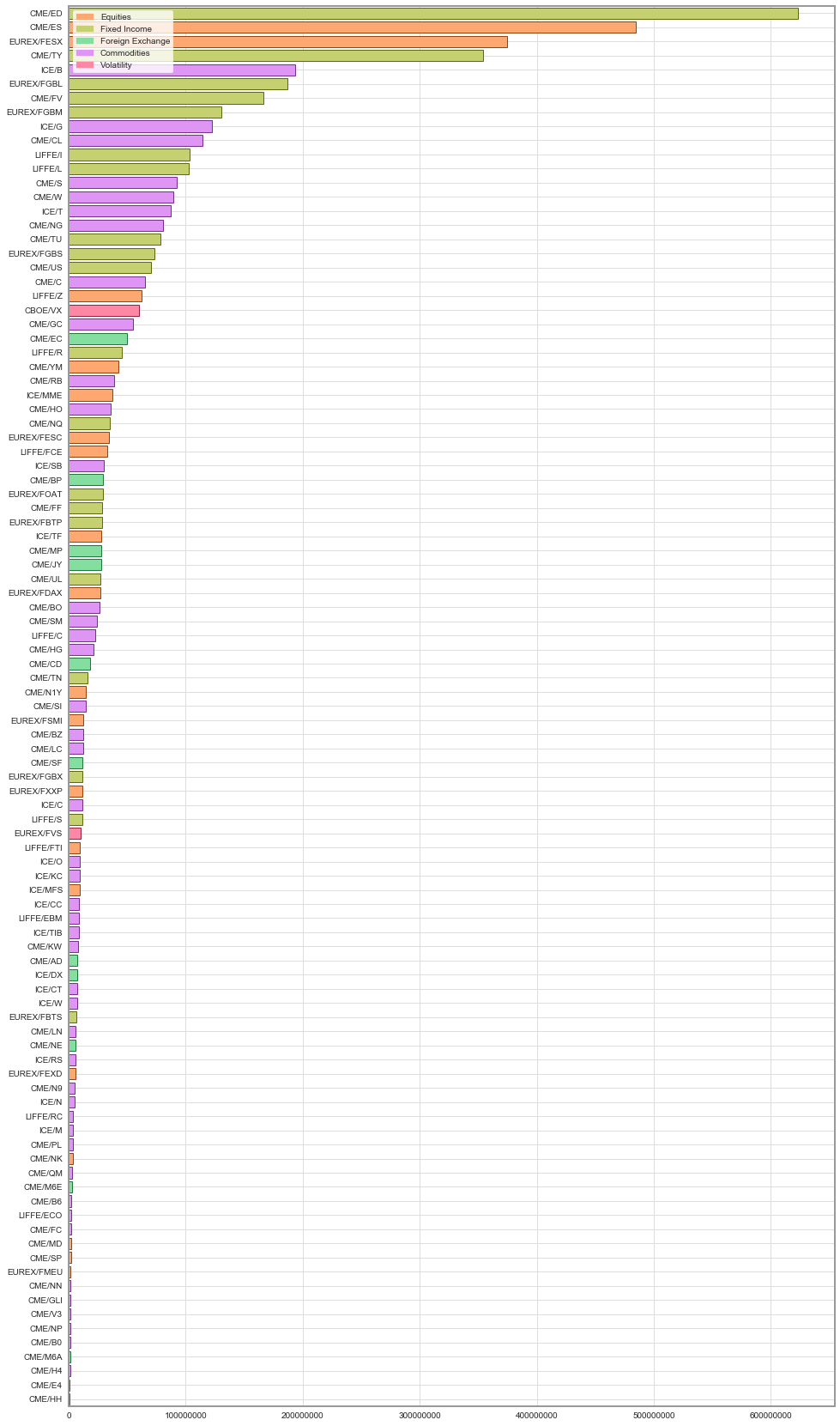

Let's see how this data looks on the graph (volume, for each futures type):

We can see on the graph that the most heavily traded types of contracts, but it's not clear what CME/ED means. For that, I've prepared the same data in the form of a table, which gives a more detailed look into what each futures actually is.

| Exchange | Code | Volume | |

|---|---|---|---|

| Eurodollar Futures | CME | ED | 623'360'644 |

| E-mini S&P 500 Futures | CME | ES | 484'356'164 |

| EURO STOXX 50 Index Futures | EUREX | FESX | 374'448'391 |

| 10 Year Treasury Note Futures | CME | TY | 354'309'424 |

| Brent Crude Oil Futures | ICE | B | 193'572'941 |

| Euro-Bund Futures | EUREX | FGBL | 186'621'883 |

| 5 Year Treasury Note Futures | CME | FV | 166'237'866 |

| Euro-Bobl Futures | EUREX | FGBM | 130'668'939 |

| Low Sulphur Gasoil Futures | ICE | G | 122'278'270 |

| Crude Oil Futures | CME | CL | 114'159'170 |

| EURIBOR Futures | LIFFE | I | 103'175'690 |

| Short Sterling Futures | LIFFE | L | 102'914'799 |

| Soybeans Futures | CME | S | 92'648'132 |

| Wheat Futures | CME | W | 89'726'100 |

| WTI Crude Futures | ICE | T | 87'252'726 |

| Natural Gas Futures | CME | NG | 80'979'159 |

| 2-Year Treasury Note Futures | CME | TU | 78'784'782 |

| Euro-Schatz Futures | EUREX | FGBS | 73'604'489 |

| Treasury Bond Futures | CME | US | 70'274'465 |

| Corn Futures | CME | C | 64'930'203 |

| FTSE 100 Index Futures | LIFFE | Z | 62'361'538 |

| S&P 500 Volatility Index VIX Futures | CBOE | VX | 60'124'279 |

| Gold Futures | CME | GC | 55'201'414 |

| Euro Futures | CME | EC | 49'904'967 |

| Long Gilt Futures | LIFFE | R | 45'693'167 |

| E-mini Dow ($5) Futures | CME | YM | 42'428'583 |

| RBOB Gasoline Futures | CME | RB | 39'158'655 |

| mini MSCI Emerging Markets Index Futures | ICE | MME | 37'559'484 |

| Heating Oil Futures | CME | HO | 35'883'454 |

| E-mini NASDAQ 100 Futures | CME | NQ | 35'102'564 |

| EURO STOXX Banks Futures | EUREX | FESC | 34'784'728 |

| CAC40 Index Futures | LIFFE | FCE | 33'388'481 |

| Sugar No. 11 Futures | ICE | SB | 30'358'748 |

| British Pound Futures | CME | BP | 29'214'521 |

| Euro-OAT Futures | EUREX | FOAT | 29'041'392 |

| Federal Funds Futures | CME | FF | 28'744'178 |

| Long-Term Euro-BTP Futures | EUREX | FBTP | 28'339'932 |

| Russell 2000 Index Futures | ICE | TF | 28'082'021 |

| Mexican Peso Futures | CME | MP | 27'960'374 |

| Japanese Yen Futures | CME | JY | 27'539'228 |

| Ultra T-Bond Futures | CME | UL | 27'351'459 |

| DAX Futures | EUREX | FDAX | 27'261'861 |

| Soybean Oil Futures | CME | BO | 26'170'836 |

| Soybean Meal Futures | CME | SM | 24'544'082 |

| Cocoa Futures (Europe) | LIFFE | C | 22'404'036 |

| Copper Futures | CME | HG | 21'264'498 |

| Canadian Dollar Futures | CME | CD | 18'669'492 |

| Ultra 10-Year U.S. Treasury Note Futures | CME | TN | 16'179'235 |

| Nikkei/Yen Futures | CME | N1Y | 14'777'311 |

| Silver Futures | CME | SI | 14'450'711 |

| SMI Futures | EUREX | FSMI | 12'745'019 |

| Brent Crude Oil Financial (Brent look-alike) Futures | CME | BZ | 12'565'789 |

| Live Cattle Futures | CME | LC | 12'391'693 |

| Swiss Franc Futures | CME | SF | 11'979'028 |

| Euro-Buxl Futures | EUREX | FGBX | 11'840'848 |

| STOXX Europe 600 Index Futures | EUREX | FXXP | 11'707'122 |

| ECX EUA Futures (Carbon emission allowance) | ICE | C | 11'696'874 |

| EUROSWISS Futures | LIFFE | S | 11'412'116 |

| VSTOXX Futures | EUREX | FVS | 10'084'867 |

| AEX Index Futures | LIFFE | FTI | 9'834'242 |

| Heating Oil Futures | ICE | O | 9'546'192 |

| Coffee Futures | ICE | KC | 9'288'386 |

| mini MSCI EAFE Index Futures | ICE | MFS | 9'256'126 |

| Cocoa Futures (US) | ICE | CC | 9'184'497 |

| Milling Wheat Futures | LIFFE | EBM | 8'975'719 |

| Brent NX/WTI Crude Spr | ICE | TIB | 8'594'794 |

| KC Hard Red Winter (HRW) Wheat Futures | CME | KW | 7'916'924 |

| Australian Dollar Futures | CME | AD | 7'559'031 |

| Dollar Index Futures | ICE | DX | 7'393'376 |

| Cotton No. 2 Futures | ICE | CT | 7'193'884 |

| White Sugar Future | ICE | W | 7'155'924 |

| Short-Term Euro-BTP Futures | EUREX | FBTS | 6'766'913 |

| Lean Hogs Futures | CME | LN | 6'185'359 |

| New Zealand Dollar Futures | CME | NE | 5'917'640 |

| Canola Futures | ICE | RS | 5'694'269 |

| EURO STOXX 50 Index Dividend Futures | EUREX | FEXD | 5'651'611 |

| PJM Western Hub Real-Time Off-Peak Calendar-Month 5 MW Futures | CME | N9 | 5'373'924 |

| (RBOB) Gasoline Futures | ICE | N | 5'243'717 |

| Robusta Coffee Futures | LIFFE | RC | 4'058'659 |

| UK Natural Gas Futures | ICE | M | 3'895'650 |

| Platinum Futures | CME | PL | 3'832'722 |

| Nikkei/USD | CME | NK | 3'458'658 |

| E-mini Crude Oil Futures | CME | QM | 3'077'874 |

| E-micro Euro/American Dollar Futures | CME | M6E | 2'644'770 |

| PJM Northern Illinois Hub Real-Time Off-Peak Calendar-Month 5 MW Futures | CME | B6 | 2'556'120 |

| Rapeseed Futures | LIFFE | ECO | 2'544'661 |

| Feeder Cattle Futures | CME | FC | 2'507'076 |

| S&P MidCap Futures | CME | MD | 2'459'370 |

| S&P500 Futures | CME | SP | 1'880'020 |

| MSCI Europe Index Futures | EUREX | FMEU | 1'727'702 |

| Henry Hub Swap Futures | CME | NN | 1'703'891 |

| European Low Sulphur Gasoil (100mt) Bullet Futures | CME | GLI | 1'456'598 |

| PJM AEP Dayton Hub Real-Time Off-Peak Calendar-Month 5 MW Futures | CME | V3 | 1'393'037 |

| Henry Hub Penultimate NP Futures | CME | NP | 1'325'230 |

| Mont Belvieu LDH Propane (OPIS) Futures | CME | B0 | 1'226'275 |

| E-micro Australian Dollar/American Dollar Futures | CME | M6A | 1'215'204 |

| MISO Indiana Hub (formerly Cinergy Hub) Real-Time Off-Peak Calendar-Month 5 MW Futures | CME | H4 | 1'137'840 |

| PJM Western Hub Day-Ahead Off-Peak Calendar-Month 5 MW Futures | CME | E4 | 1'129'110 |

| Natural Gas (Henry Hub) Last-day Financial Futures | CME | HH | 1'096'276 |

| Coal (API2) CIF ARA (ARGUS-McCloskey) Futures | CME | MTF | 1'089'966 |

We can see that the most popular futures market in the United States and Europe is the Eurodollar - contracts for interbank 3-month dollar deposits outside of the US – over 600 million lots traded. They're closely followed by stock index futures S&P 500 and EUROSTOXX 50 which are major stock indexes from the US and Europe respectively. On that list we can also see a lot of commodities, represented for example by Crude Oil, Wheat or Soybeans, currencies – among others EUR/USD , GBP/USD and MXN/USD.

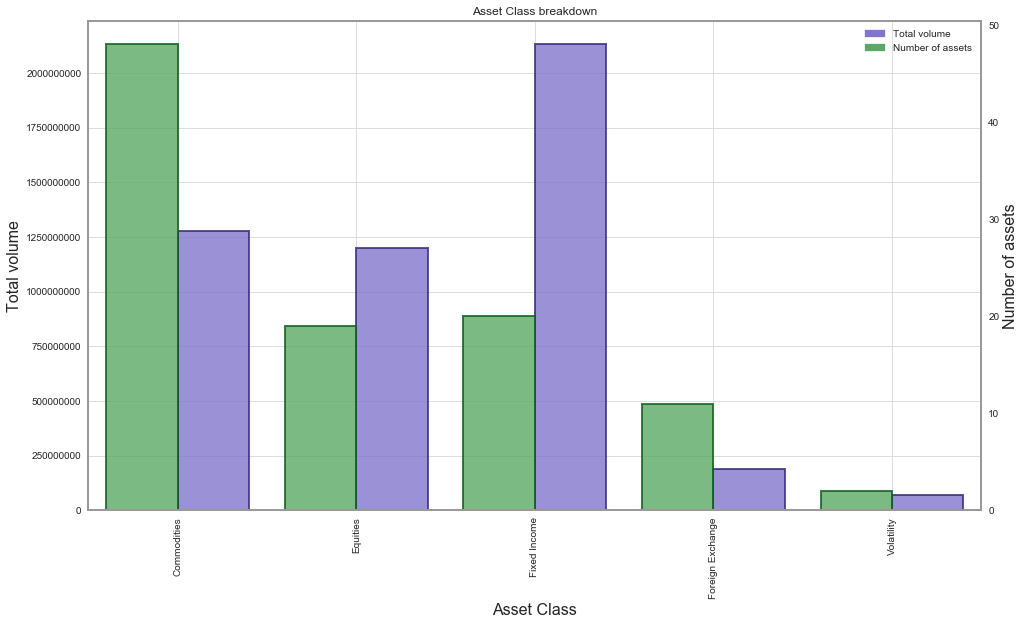

The least represented is the volatility asset class with VIX and VSTOXX index futures available for trading. Below you can see a breakdown of both – volume and number of assets among asset classes:

Closing remarks

I hope I have scratched the surface of introductory knowledge to futures. You should know by now what futures are, where they are traded and what kind of different markets are the most popular.

If you have any questions not answered in this article, please ask them in the comments!

References

- [1] http://www.investopedia.com/terms/f/forwardcontract.asp

- [2] https://en.wikipedia.org/wiki/Futures_contract

- [3] https://en.wikipedia.org/wiki/Clearing_(finance)

- [4] http://futuresfundamentals.cmegroup.com/glossary/#clearing-house

- [5] https://www.quandl.com/

- [6] https://www.statista.com/statistics/272832/largest-international-futures-exchanges-by-number-of-contracts-traded/

- [7] http://thedailywtf.com/articles/Special-Delivery